Overview

Mastering a denture payment plan can feel overwhelming, but we understand that finding the right financing options is essential for your peace of mind. Are you tired of lengthy dental visits and complicated payment structures? By exploring various options such as:

- Insurance coverage

- Flexible payment plans

- Health savings accounts

You can discover an approach that fits your budget and alleviates stress.

Furthermore, assessing affordability through a budget analysis is crucial. This means that comparing key features of different payment plans can empower you to make informed financial decisions. We aim to support busy professionals like you in navigating these choices with ease and comfort, ensuring that your experience is as stress-free as possible. Your comfort is our priority, and we’re here to help you every step of the way.

Introduction

Navigating the world of denture payment plans can often feel overwhelming, especially for busy professionals juggling multiple financial responsibilities. Are you tired of feeling lost among the myriad of options? From insurance coverage to flexible payment plans, understanding how to manage these costs is essential.

This article explores effective strategies that simplify the decision-making process and empower you to take control of your dental expenses. Your comfort is our priority—how can you ensure that you make the most informed choice while balancing your budget and long-term financial goals?

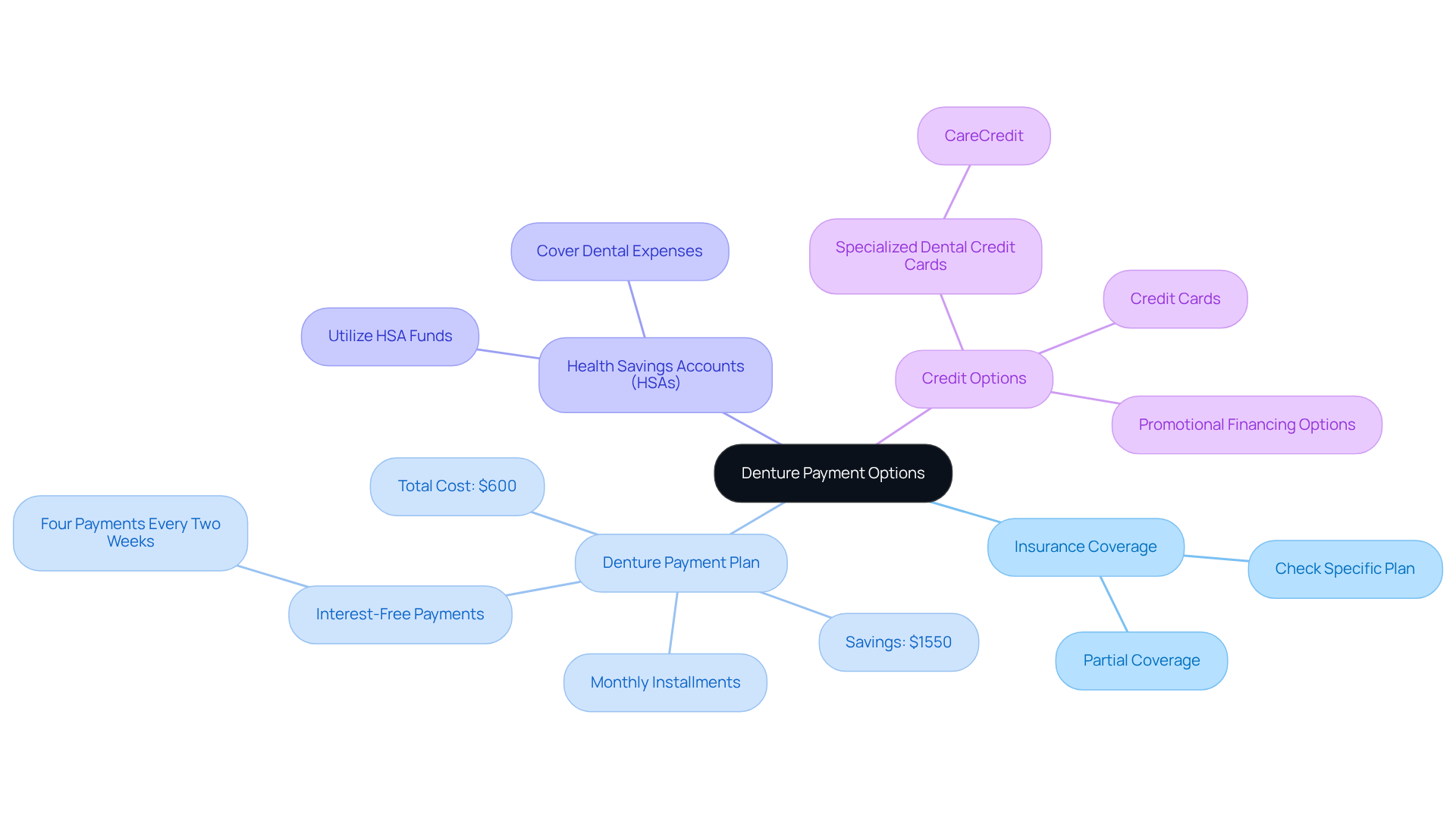

Explore Different Denture Payment Options

When considering dental prosthetics, are you feeling overwhelmed by the available options? At DentKits, we understand that navigating these choices can be stressful, but we’re here to help you save significantly. Here are some options to consider:

- Insurance Coverage: Many can cover a portion of denture costs. It’s essential to check your specific plan to understand what is included.

- Denture Payment Plan: DentKits provides a flexible denture payment plan, enabling you to cover your complete oral prosthetics for just $600. This represents a remarkable saving of $1550 compared to the national average of $2200. You can select a denture payment plan that offers or opt for four interest-free payments every two weeks, making it easier to fit into your budget.

- Health Savings Accounts (HSAs): If you have an HSA, you can utilize these funds to cover , including dentures.

- Credit Options: Some patients may find it beneficial to use credit cards or specialized dental credit cards like CareCredit, which provide promotional financing options.

By understanding these alternatives, busy professionals can confidently select the best financial approach that meets their needs and budget. At DentKits, your comfort is our priority, and we’re committed to providing you with innovative dental solutions that make your experience as seamless as possible.

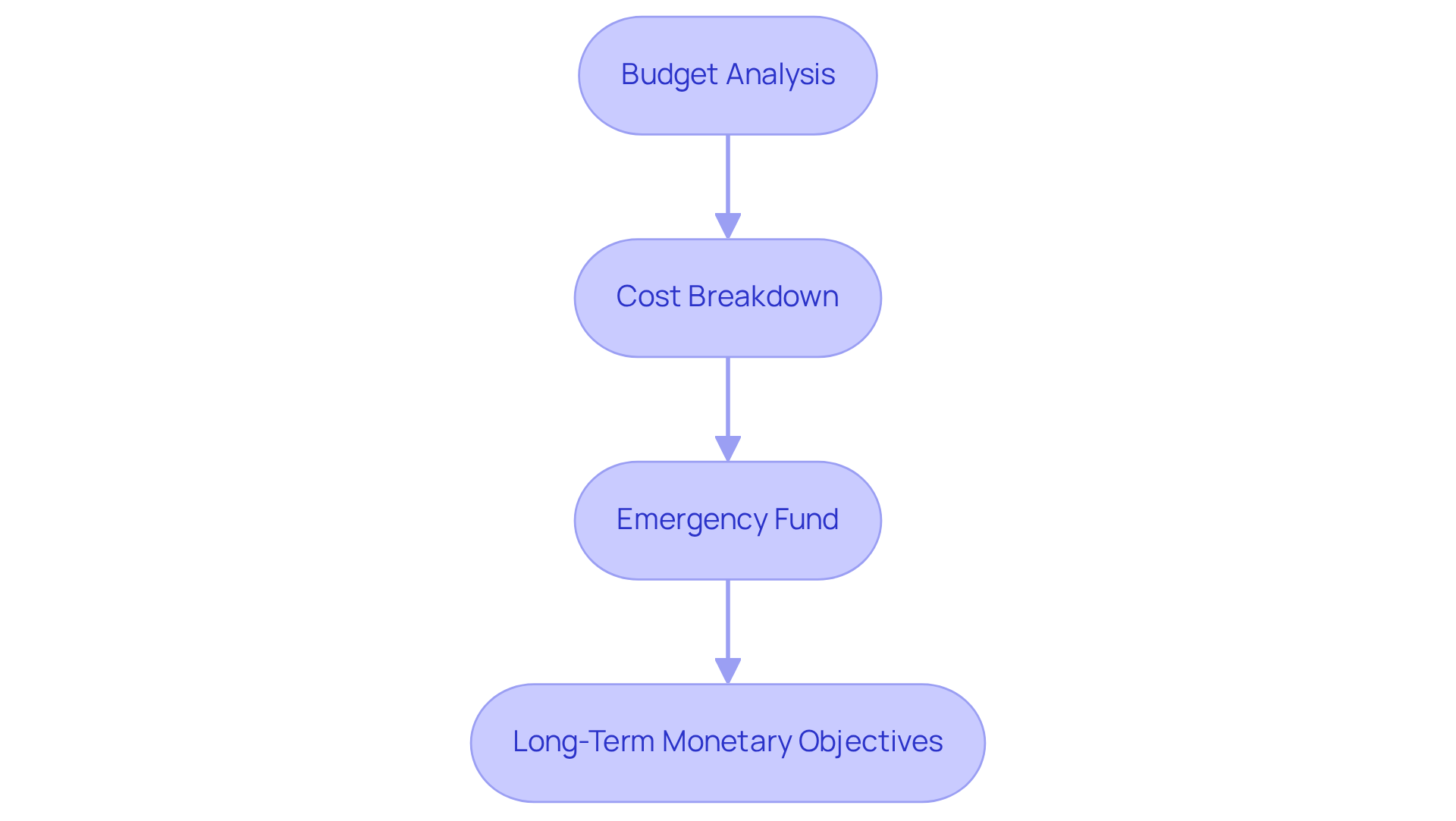

Assess Affordability and Financial Flexibility

To effectively assess affordability, let’s explore some important steps together:

- Budget Analysis: Have you taken a moment to review your ? Understanding how much you can comfortably allocate towards a is crucial, ensuring you don’t compromise on other .

- Cost Breakdown: It’s essential to grasp the . This includes any additional charges for fittings, adjustments, or follow-up appointments that might arise.

- Emergency Fund: Do you have a reserve in place? Ensuring you have funds to cover unforeseen costs during the billing cycle can provide peace of mind.

- : Reflect on how the fits into your long-term monetary objectives. Are you saving for retirement or planning for other major acquisitions?

By performing a , you can ensure that your financing strategy aligns with your financial abilities. Remember, your comfort is our priority, and we’re here to support you on this journey.

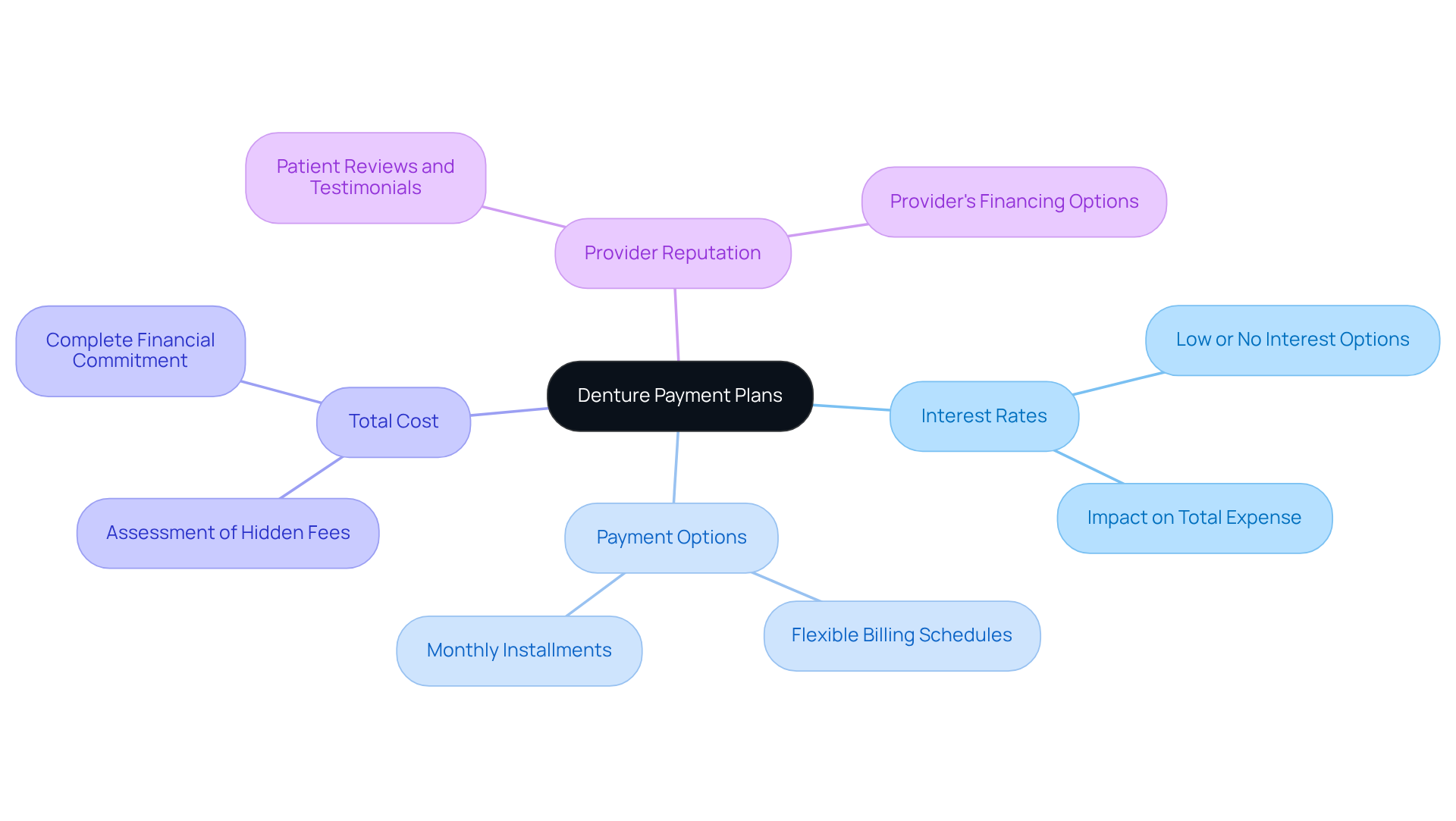

Compare Features and Benefits of Payment Plans

When evaluating , we understand that it’s essential to consider several key features and benefits that can ease your decision-making process:

- Interest Rates: Are you tired of high-interest charges that can significantly increase the total expense of dentures? Opt for plans that offer to keep your investment manageable over time.

- Payment Options: Many arrangements provide , allowing you to choose monthly installments that suit your budget. This flexibility is crucial for busy professionals juggling multiple expenses.

- Total Cost: It’s important to assess the , including any potential hidden fees or charges. Understanding the complete helps you avoid surprises later on.

- Provider Reputation: Investigate the reputation of the concerning their financing options. can offer valuable insights into the experiences of others, helping you make an informed decision.

Furthermore, with DentKits, a U.S. licensed dentist will examine and recommend your personalized , ensuring quality and care. We believe that your comfort is our priority. DentKits provides innovative custom solutions for dental prosthetics crafted using advanced and skilled craftsmanship, which can improve the overall experience of acquiring prosthetics. By thoroughly comparing these features and considering the broader context of dental financing, you can select a denture payment plan that not only fits your budget but also reduces financial stress, ensuring a smoother path to achieving your desired smile.

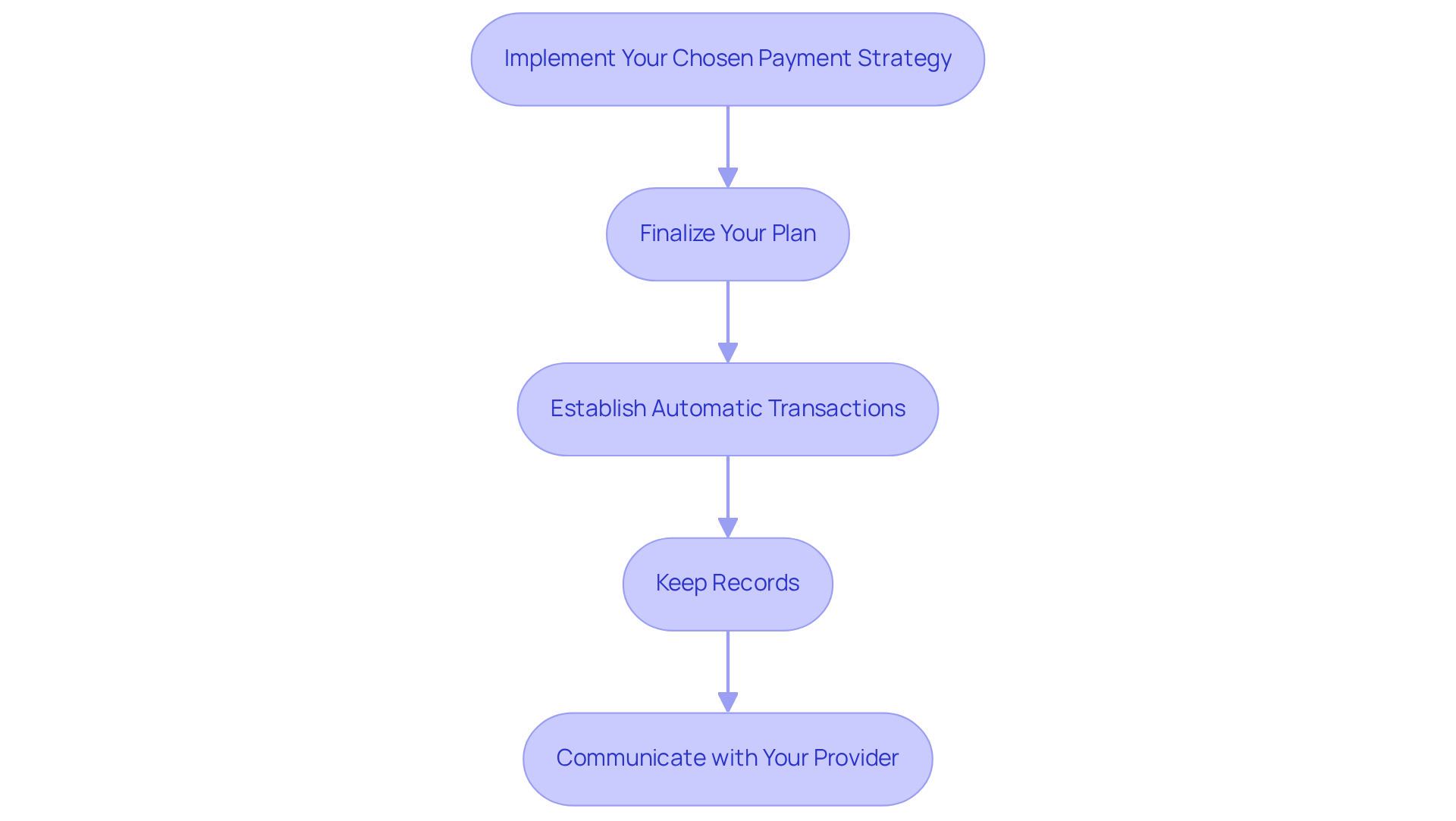

Implement Your Chosen Payment Strategy

To effectively implement your , we understand that navigating this process can be challenging. Consider the following steps to ease your journey:

- Finalize Your Plan: Confirm the specifics of your payment plan with your . It’s essential to ensure clarity on all terms and conditions, so you feel secure in your choices.

- Establish : Are you tired of worrying about missed due dates? Create automatic transactions whenever feasible to prevent late charges that can accumulate quickly. Studies suggest that can greatly lessen economic stress for patients.

- : Maintaining thorough records of all payments, including receipts and statements, is vital. This practice not only assists in but also guarantees accuracy in your accounts.

- : Should you encounter any monetary challenges, don’t hesitate to reach out to your dental provider promptly. Many practices are willing to discuss or modifications, promoting a supportive relationship that can alleviate economic burdens.

By following these steps, you can manage your denture payments effectively. Your comfort is our priority, allowing you to focus on without the added stress of financial concerns.

Conclusion

Navigating the complexities of denture payment plans can be daunting, especially for busy professionals. Are you feeling overwhelmed by the variety of options available? Understanding your choices—from insurance coverage to flexible payment plans—empowers you to make informed decisions that align with your financial capabilities. Our goal is to simplify this process, ensuring that achieving a beautiful smile is both attainable and stress-free.

Key insights discussed include:

- The importance of assessing affordability through budget analysis and cost breakdowns.

- Comparing the features and benefits of different payment plans is essential.

- By evaluating interest rates, payment options, and provider reputations, you can select a financing strategy that minimizes financial strain while maximizing comfort and care.

- Implementing your chosen payment strategy with clear communication and diligent record-keeping further enhances the management of denture costs.

Ultimately, embracing these smart strategies not only alleviates the stress associated with denture payments but also reinforces the significance of prioritizing your dental health without compromising your financial well-being. We understand that taking proactive steps towards financial planning for dental care is crucial. This ensures that busy professionals like you can confidently invest in your smiles, leading to an improved overall quality of life.

Frequently Asked Questions

What are the main denture payment options available?

The main denture payment options include insurance coverage, flexible denture payment plans from DentKits, Health Savings Accounts (HSAs), and credit options such as credit cards or specialized dental credit cards like CareCredit.

How does insurance coverage work for dentures?

Many dental insurance plans cover a portion of denture costs, but it is essential to check your specific plan to understand what is included.

What is the cost of the denture payment plan offered by DentKits?

DentKits offers a flexible denture payment plan for a total of $600, which is a saving of $1550 compared to the national average cost of $2200.

What payment options are available under the DentKits payment plan?

The DentKits payment plan allows for manageable monthly installments or the option to make four interest-free payments every two weeks.

Can I use my Health Savings Account (HSA) to pay for dentures?

Yes, if you have a Health Savings Account (HSA), you can utilize those funds to cover dental expenses, including dentures.

What credit options are available for financing dentures?

Patients may use standard credit cards or specialized dental credit cards like CareCredit, which offer promotional financing options for dental expenses.